Do Doctors Get Paid More For Services Or Value Care

Jan 15, 2019

How (and how much) doctors are paid: why information technology matters

How we pay doctors through our public health organisation is an important issue that receives little public scrutiny, despite the fact that medico compensation represents a significant share of the provincial budget and has been among the fastest-growing health care costs in recent years.

A very useful analysis was conducted past BC's Accountant General in 2014. He institute that British Columbia paid over $three.6 billion to its x,346 physicians in 2011/12, comprising nearly 9 per cent of the total provincial budget.1 To put this in perspective, that'south most the aforementioned amount of public funding allocated to social services and housing combined (ix.4 per cent in 2011/12).ii

In that location are two main doc payment models in BC. The bulk of physicians receive regime payments under the fee-for-service model, essentially working as independent contractors who beak our public insurance plan (the Medical Services Plan or MSP).

Under fee-for-service bounty, physicians pecker MSP for each service provided (each has a split billing code and a charge per unit negotiated between the Ministry building of Wellness and Doctors of BC). According to the Auditor General, in 2011/12 fee-for-service payments totalled $3 billion.3 The fee-for-service funding stream differs from how public funds are allocated for the bulk of other wellness care providers, largely considering most are compensated under negotiated collective agreements that provide government with certainty near expenditures over the life of the collective agreement (ofttimes 3–4 year terms). Merely since fee-for-service payments do not have a maximum cap in any fiscal year, this compensation model poses challenges to constructive planning and management of public health care spending.

In improver to fee-for-service bounty, the Alternative Payment Programme (APP) pays for contracted doc services through sessional and salaried compensation models (likewise referred to equally service contracts). Some physicians who work in hospitals and health authority clinical settings, such every bit full general practitioners in the emergency room, are paid through such contracts. APP paid out $410 million in 2011/12 to physicians.4

More recent information from the Canadian Institute for Health Information shows that fee-for-service payments in BC comprised 79 per cent of total physician payments in 2015/16.v

Physicians are well-compensated—and paid more than than v times the average BC worker

Sixteen years agone, the Royal Commission on the Futurity of Health Care in Canada (known as the Romanow Commission) expressed business that the rising income of physicians could threaten efforts to contain health care costs.6 The Romanow Commission'south concerns were prescient. In 2013, economists Hugh Grant (University of Winnipeg) and Jeremiah Hurley (McMaster University) found that betwixt 2001 and 2010, net existent dr. income in Canada increased from $187,134 to $248,113.vii They ended:

"In the 11 years since the Romanow Commission warned that the income of physicians was threatening to go a significant commuter of Canadian health-care costs, doctors in this land proceeded to chalk upwardly some of their nigh rapid gains in earnings since the implementation of medicare. Since 2000, the gap betwixt what the average dr. makes, and what the average fully employed Canadian worker earns, has diverged like never before. … All of this has occurred while physicians accept actually provided slightly fewer services to patients."8

Similarly, a 2011 Canadian Institute for Health Data (CIHI) report found that doc compensation was among the fastest-growing drivers of wellness care costs over the previous decade (1998-2008). Indeed, physician pay increased by an average 6.8% per year over that period, far outstripping the gains for other workers in health and social services.9 A little more than half of this increase (three.half dozen% per year) was attributed to growth in fee-for-service billing schedules.

In BC, the boilerplate doc received $284,918 in gross payments from the provincial authorities in 2015/16—more than v times the almanac employment income of the average total-fourth dimension worker in BC ($55,776). Payments to the average md (not necessarily working full-time) were significantly higher than incomes of workers in any other wellness occupation (with non-md pay averaging $58,114), including nursing ($71,168) and not-nursing health professions ($74,008).10

Why does this matter?

The above figures practice not reflect the overhead costs many physicians must pay (such equally for leasing clinic infinite and paying staff)—an event discussed in greater detail below. Nevertheless, at that place is a wide gap between the incomes of physicians, other health care providers and the average BC worker, which contributes to the troubling growth of severe income inequality. Ironically, nosotros know from a large trunk of bear witness that rising inequality is directly connected with poor health among lower-income groups and higher public health care costs (e.g. increased rates of hospitalization and chronic disease), among other societal issues.eleven Instead of helping improve health, high md pay is contributing to the larger problem of inequality.

The earnings gap between physicians: 97 of BC's top 100 highest-paid physicians are specialists

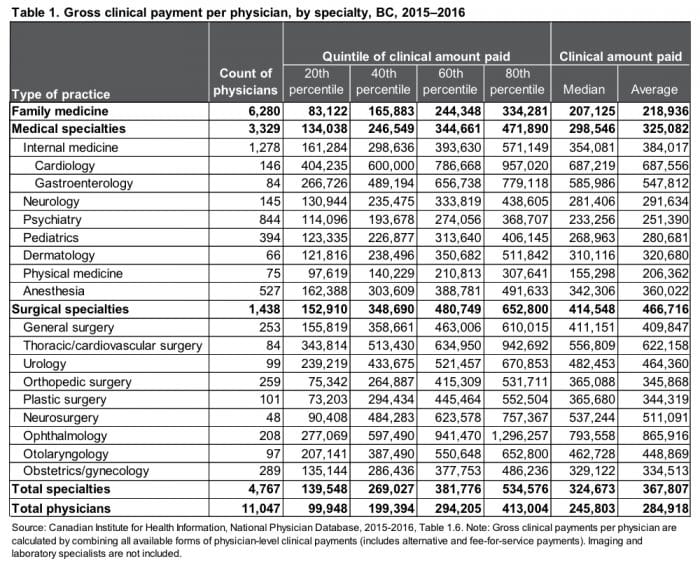

Another important issue is the wide gap in earnings between family physicians and specialists in BC (see Tabular array 1).12 The divergence between the average clinical amount paid to a family md ($218,936) and the boilerplate specialist ($367,807) is nigh $150,000. The difference in earnings is greatest between surgeons and family unit physicians, with the average surgeon earning more than twice the average family dr.. In some specialty areas, ophthalmology in item, the gap in clinical payments is stunning. An ophthalmologist in the fourscoreth percentile will gross nearly $1.three million per year—more than six times the average family doctor.

The list of the top 100 highest-billing physicians in 2015/sixteen illustrates this divide.13 Among these practitioners, 97 were specialists, with ophthalmology (62) the leading practice area followed by cardiology (20). MSP payments to the top 100 highest-billing physicians ranged from $1,051,859 to $3,306,401.

What accounts for this gap?

In some specialty areas, such equally ophthalmology, advances in techniques have significantly reduced the time required to perform procedures that were in one case more complex (east.g., the time to perform cataract surgery has been reduced from 1 hour to 15 minutes). All the same, the fee-for-service billing schedule has not significantly changed to reverberate this reality. Every bit the Accountant General notes, information technology took half-dozen years for the Ministry of Health to get approving from the Medical Services Commissionfourteen to reduce the cataract fee, which was finally done in 2018. Even then, ophthalmologists unsuccessfully tried to block the change by taking the Province to court.15

Figures for the top 100 highest-billing physicians highlight the claiming of containing health care costs under the fee-for-service compensation model, which financially rewards volume-based medicine even though a growing body of show has documented that more treatments and surgeries practise not always do good patients and can even cause impairment.xvi

Untangling physician pay

At that place are several important limitations when interpreting physician payment data from the Canadian Institute for Health Data and the BC Medical Services Plan:

- Many doctors have significant overhead costs, including leasing clinic space and paying office staff. Nether our dominant fee-for-service contained contractor model, these costs must come up out of gross MSP payments. Put another way, gross payments practice not equal a physician's net income. There is very picayune loftier-quality peer-reviewed research on typical overhead expenses. A 2012 study of cocky-reported overhead for Ontario physicians estimated that overhead ranged from 12.5 to 42.5 per cent.17 However, for some physicians—specialists, in item—wellness regime or academic institutions may cover overhead costs depending on the particular practice setting. That said, even if the boilerplate BC ophthalmologist's overhead were 42.5 per cent of gross earnings, their average earnings would nevertheless be much higher than most other specialists and physicians and their internet income would withal be virtually nine times that of the boilerplate full-time worker.eighteen

- Physicians have access to a number of tax loopholes that are not available to most Canadians and that disproportionately benefit high-income earners. Alberta and BC lead the country in physicians' apply of medical practice incorporation through a "Canadian-Controlled Private Corporation" (CCPC). In 1996, 44.two per cent of BC physicians in private practice were incorporated. By 2011, this had jumped to just over lxx per cent.nineteen A recent study on the employ of CCPCs found that, on average, "incorporated physicians realized a four per cent reduction in personal income taxes and accumulated retained earnings of at least $x,000 annually in their CCPC from 1996 to 2011."20 The financial benefits of incorporation stem from retained earnings and income splitting. Some positive changes to income splitting last year by the federal government have reduced the amount of tax avoidance possible.

- Third-party billings are another significant income source for physicians, which include WorkSafeBC clients, ICBC clients and services billed to the War machine, Corrections Canada and the federal Refugee Health Programme.

- Extra-billing is also non captured in payments from the provincial government. BC has adult an unfortunate reputation due to some physician- and investor-owned clinics charging illegal out-of-pocket fees to patients in commutation for faster access. A 2012 BC authorities audit plant extensive illegal extra-billing and overlapping claims to MSP by Brian Day'southward two for-turn a profit clinics (Cambie Surgery Heart and Specialist Referral Clinic). In 2017, a Globe and Postal service investigation found "hundreds of examples of extra-billing and double-dipping by BC doctors in provincial audits…" A March 2017 internal regime memo, released under Freedom of Data, reveals how pervasive the issue may exist. By Baronial 2017, the new BC government announced three individual clinic audits in society to investigate suspected violations of the Canada Health Act and prevent the claw dorsum of federal wellness care funding (for every dollar of extra-billing, the Province loses a dollar in federal funding). The memo states that an additional seven private clinics are awaiting audits for potential extra-billing dating back to 2008. The reason these audits were not conducted is redacted, but internal Ministry of Health resourcing to conduct the audits appears to be at issue.

Time to rethink physician compensation

Notwithstanding the challenges in untangling physician pay, we know that doctors in Canada and BC are well compensated for the of import work they practise. The University of Toronto'southward Gregory Marchildon and Michael Sherar concluded in a recent newspaper that "Canadian doctors are among the more highly remunerated among the OECD countries for which data are available. Moreover, the growth in remuneration, especially for specialists, is amongst the very highest in these OECD countries."21

What is notable almost British Columbia is that we lag behind other provinces and jurisdictions in introducing alternative physician compensation models that better support high-quality, toll-effective, team-based intendance.22

In Scotland, for example, a new contract for general practitioners moves in a promising direction by gradually taking the burden of overhead and ancillary expenses away from doctors and introducing a population-based payment model (called capitation). In time, this approach will let for much greater clarity between government and the medical association when negotiating bounty. It will seek to eliminate uncertainties and disagreements that arise when negotiating overhead costs, which can vary considerably between physicians and practise location.

In Canada, negotiations betwixt medical associations and provincial governments over compensation have oft been fractious. But this is non a reason for provincial governments, the public and physicians themselves to shy away from addressing this important issue. Equally discussed in a higher place, physician pay is a major price commuter in health care. Only doctors are also gatekeepers for other health services, which ways physician bounty is closely linked to issues of health arrangement governance, accountability, cost-effectiveness and quality.23 That BC'due south compensation models do not accost these problems was one of the major concerns raised past BC'due south Accountant General, who recommended that BC "rebuild doc compensation models so they align with the delivery of high-quality, cost-constructive doctor services."24

Still, we are making progress in BC. The provincial government has recognized the limitations of fee-for-service physician remuneration and the growing preference of new medical school graduates for alternatives.25 Last May, the BC government announced opportunities for 200 recent family medicine graduates to work under a new compensation model. The success of this initiative will depend in large part on shifting towards prove-based not-profit principal intendance models—such as Community Wellness Centres26—that tin can provide physicians new opportunities to work with a team of health care providers, including pharmacists, nurse practitioners and social workers.

Modernizing physician bounty volition accost a widely recognized barrier to integrated and collaborative team-based primary intendance.27 It will also better marshal physician compensation with broader wellness arrangement goals of achieving college quality and more cost-effective care. This kind of innovation is long overdue and I hope to see more of it in the months and years to come.

———

Read CCPA-BC's recommendations for priorities and funding for health care in BC'southward 2019 budget.

Notes

- Auditor General of British Columbia (2014), Oversight of Dr. Services, p. four.

- BC Ministry building of Finance (2018), Kickoff Quarterly Report September 2018, p. 59.

- Auditor Full general of British Columbia (2013), Wellness Funding Explained, p. 16.

- Auditor General of British Columbia (2013), Health Funding Explained, p. xvi.

- Canadian Institute for Health Information, National Physician Database, 2015-2016, Table ane.2.

- Commission on the Future of Health Care in Canada (2002), Building on Values: The Future of Wellness Intendance in Canada – Concluding Report, p, 102.

- Hugh G. Grant and Jeremiah Hurley (2013), Unhealthy Pressure: How Physician Pay Puts the Clasp on Health-Care Budgets, The School of Public Policy, University of Calgary, p. 11.

- Hugh Thousand. Grant and Jeremiah Hurley (2013), Unhealthy Force per unit area: How Doctor Pay Puts the Clasp on Health-Care Budgets, The Schoolhouse of Public Policy, University of Calgary, p. one.

- Canadian Institute for Health Information (2011), Health Care Toll Drivers: The Facts, p. vi.

- Statistics Canada, Tabular array 14-ten-0307-01, Employee wages by occupation, almanac, retrieved November 24, 2018. 2016 average weekly wage rates are used and assumes 52 weeks of employment income.

- Richard Wilkinson and Kate Pickett (2009),The Spirit Level: Why More Equal Societies Almost Always Practice Better. London: Penguin; Michael Marmot (2015),The Wellness Gap: The Claiming of an Unequal World, New York: Bloomsbury Printing; Clare Bambra (2016),Health Divides: Where You Live Tin Kill You, Bristol: Policy Press; Danny Dorling (2017),The Equality Consequence: Improving Life for Everyone, Oxford: New Internationalist.

- See also: Hugh M. Grant and Jeremiah Hurley (2013), Unhealthy Force per unit area: How Physician Pay Puts the Squeeze on Health-Intendance Budgets, The Schoolhouse of Public Policy, University of Calgary, pp. 16-17.

- Author's assay of MSP Blue Volume, https://catalogue.data.gov.bc.ca/dataset/msp-blue-book, retrieved November 11, 2018. Physician practise specialties were determined by cantankerous-referencing the College of Medico and Surgeons of British Columbia's Physician Directory bachelor at https://www.cpsbc.ca/physician_search.

- The Medical Services Commission is a statutory committee fabricated up Doctors of BC representatives, government officials, and public members with the responsibility of managing BC'southward Medical Services Plan in a cost-effective manner.

- Auditor General of British Columbia (2014), Oversight of Physician Services, p. 30. The 2015/sixteen MSP billing information practise not reflect the reduced cataract surgery fee implemented in 2018.

- Charles J. Wright, G. Keith Chambers, and Yoel Robens-Paradise (2002), Evaluation of indicators for and outcomes of elective surgery, CMAJ 167(5), pp. 461-466; Andrew Longhurst, Marcy Cohen, and Margaret McGregor (2016), Reducing Surgical Look Times: The Case for Public Innovation and Provincial Leadership, Canadian Center for Policy Alternatives—BC Office, pp. 17-18. See also Choosing Wisely Canada, https://choosingwiselycanada.org/.

- Jeremy Petch, Irfan A. Dhaka, David A. Henry, Susan E. Schultz, Richard H. Glazier, and Sacha Bhatia (2012), Public payments to physicians in Ontario adjusted for overhead costs, Healthcare Policy 8(2), p. 32.

- Calculated based on average ophthalmologist gross payments ($865,916) minus overhead of 42.5% equals $497,902. Boilerplate full-time BC worker earns approximately $55,776 annually.

- Lars Nielsen and Arthur Sweetman (2018), Measuring physicians' incomes with a focus on Canadian-Controlled Private Corporations, Healthcare Papers 17(four), pp. 80-81.

- Lars Nielsen and Arthur Sweetman (2018), Measuring physicians' incomes with a focus on Canadian-Controlled Private Corporations, Healthcare Papers 17(4), p. 77.

- Gregory P. Marchildon and Michael Sherar (2018), Doctors and Canadian medicare: Improving accountability and performance, Healthcare Papers 17(4), p. 17.

- Allie Peckham, Julia Ho, and Gregory Marchildon (2018), Policy Innovations in Primary Care Access Across Canada: A Rapid Review Prepared for the Canadian Foundation for Healthcare Improvement, pp. 5-six.

- Gregory P. Marchildon and Michael Sherar (2018), Doctors and Canadian medicare: Improving accountability and performance, Healthcare Papers 17(4).

- Auditor General of British Columbia (2014), Oversight of Doctor Services, p. 8.

- Vanessa Brcic, Margaret J. McGregor, Janusz Kaczorowski, Shafik Dharamsi, Serena Verma (2012), Do and payment preferences of newly practising family physicians in British Columbians, Can Fam Physicians 58: pp. e275-281. See also: Canadian Foundation for Healthcare Improvement (2010), Myth: Near physicians prefer fee-for-service payments.

- Marcy Cohen (2014), How Tin can We Create a Price-Effective System of Primary and Community Care Congenital Around Interdisciplinary Teams? CCPA Submission to the Select Continuing Commission on Health, Canadian Centre for Policy Alternatives—BC Part; Rick H. Glazier, Brandon. 1000. Zagorski, Jennifer Rayner (2012), Comparison of Primary Care Models by Demographics, Instance Mix and Emergency Department Use, 2008/09 to 2009/10, Institute for Clinical Evaluative Sciences; Grant Yard. Russell, Simone Dahrouge, William Hogg, Robert Geneau, Laura Muldoon, Meltem Tuna (2012), Managing Chronic Disease in Ontario Primary Care: The Impact of Organizational Factors, Annals of Family Medicine 4, pp. 309-318.

- Marcy Cohen (2014), How Can We Create a Price-Constructive Arrangement of Chief and Community Intendance Built Around Interdisciplinary Teams? CCPA Submission to the Select Continuing Committee on Health, Canadian Eye for Policy Alternatives—BC Office, pp. xiv-16.

Topics: Economy, Features, Health care

Do Doctors Get Paid More For Services Or Value Care,

Source: https://www.policynote.ca/how-and-how-much-doctors-are-paid-why-it-matters/

Posted by: howejuserebeaven.blogspot.com

0 Response to "Do Doctors Get Paid More For Services Or Value Care"

Post a Comment